Think of a wireless site survey as the essential first step in building a Wi-Fi network that actually works. It's the professional process of mapping out a physical space to understand its unique radio frequency (RF) characteristics. This "blueprint" is what allows you to plan and design a network that meets your specific goals for coverage, capacity, and overall performance.

Without it, you're just guessing—and that's a recipe for spotty connections and frustrated users.

Why Your Wireless Network Needs a Site Survey First

So you've got a box of brand-new Cisco or Meraki hardware ready to go. Before you even think about mounting a single access point, let's have a friendly chat about the single most important part of any successful Wi-Fi deployment: the site survey.

Skipping this step is like building a house without checking the foundation first. You might end up with four walls and a roof, but you can't be surprised when things start to crack. A professional survey is what separates a reliable, high-performing network from one that generates a constant stream of "the Wi-Fi is slow" help desk tickets.

A proper survey digs much deeper than just walking around looking for dead zones. It's a comprehensive analysis of your building's unique RF environment. We're talking about how concrete walls, metal filing cabinets, microwave ovens, and even the Wi-Fi network from the office next door will interference with your Wi-Fi signal.

Designing a Network for Real-World Demands

Every wireless environment is different. A corporate BYOD (Bring Your Own Device) policy means the network must securely handle hundreds of varied personal devices. A busy Retail store needs flawless connectivity for its point-of-sale terminals and guest access. And in the Education sector, the demands are even greater, with networks needing to support classroom tablets, laptops, and student smartphones all at once.

A detailed site survey is what lets you plan for these real-world scenarios by answering some critical questions upfront:

- Can the network design handle modern authentication methods like IPSK or EasyPSK without slowing everyone down?

- Is the infrastructure robust enough for high-density areas, like a packed lecture hall or a busy sales floor?

- Will your guest network's Captive Portal offer a seamless, frustration-free login experience for visitors?

Key Takeaway: A site survey isn't just a technical checkbox. It's a strategic move that aligns your technology purchase with your actual business needs, ensuring the network you build is the one you truly need.

To give you a clearer picture, a comprehensive site survey involves several key pieces.

Core Components of a Wireless Site Survey

This table breaks down what a thorough survey should cover, making sure no critical aspect is left to chance.

| Component | Why It Matters for Your Network | Key Focus Area |

|---|---|---|

| RF Spectrum Analysis | Identifies non-Wi-Fi interference from sources like microwaves, Bluetooth, and cordless phones. | Locating and mitigating sources of RF noise that can degrade network performance. |

| Coverage Mapping (Heatmaps) | Visually confirms signal strength (RSSI) across the entire floor plan. | Ensuring signal is strong enough everywhere it's needed, with no unexpected dead zones. |

| Capacity Planning | Ensures the network can handle the expected number of users and devices without slowing down. | Calculating user density, application types, and required throughput per area. |

| Channel Analysis | Prevents interference between your own access points and those from neighboring networks. | Creating a channel plan that minimizes co-channel and adjacent-channel interference. |

| AP Placement | Determines the physically optimal locations to install access points for coverage and performance. | Balancing signal reach with aesthetics, security, and physical mounting constraints. |

By methodically addressing each of these components, you move from guesswork to a data-driven network design.

The demand for this level of planning is exploding. The global wireless infrastructure market was valued at USD 106.2 billion in 2023 and is on a steep growth trajectory. This massive investment is driven by the need for reliable performance, which always starts with a detailed pre-deployment survey.

This planning is absolutely crucial in environments like schools, where a stable network is the backbone of modern education. A thorough survey ensures that digital learning tools are an asset, not a source of daily frustration. You can see more on the unique challenges of building Wi-Fi in schools and how a proper survey helps overcome them.

The Three Phases of a Professional Site Survey

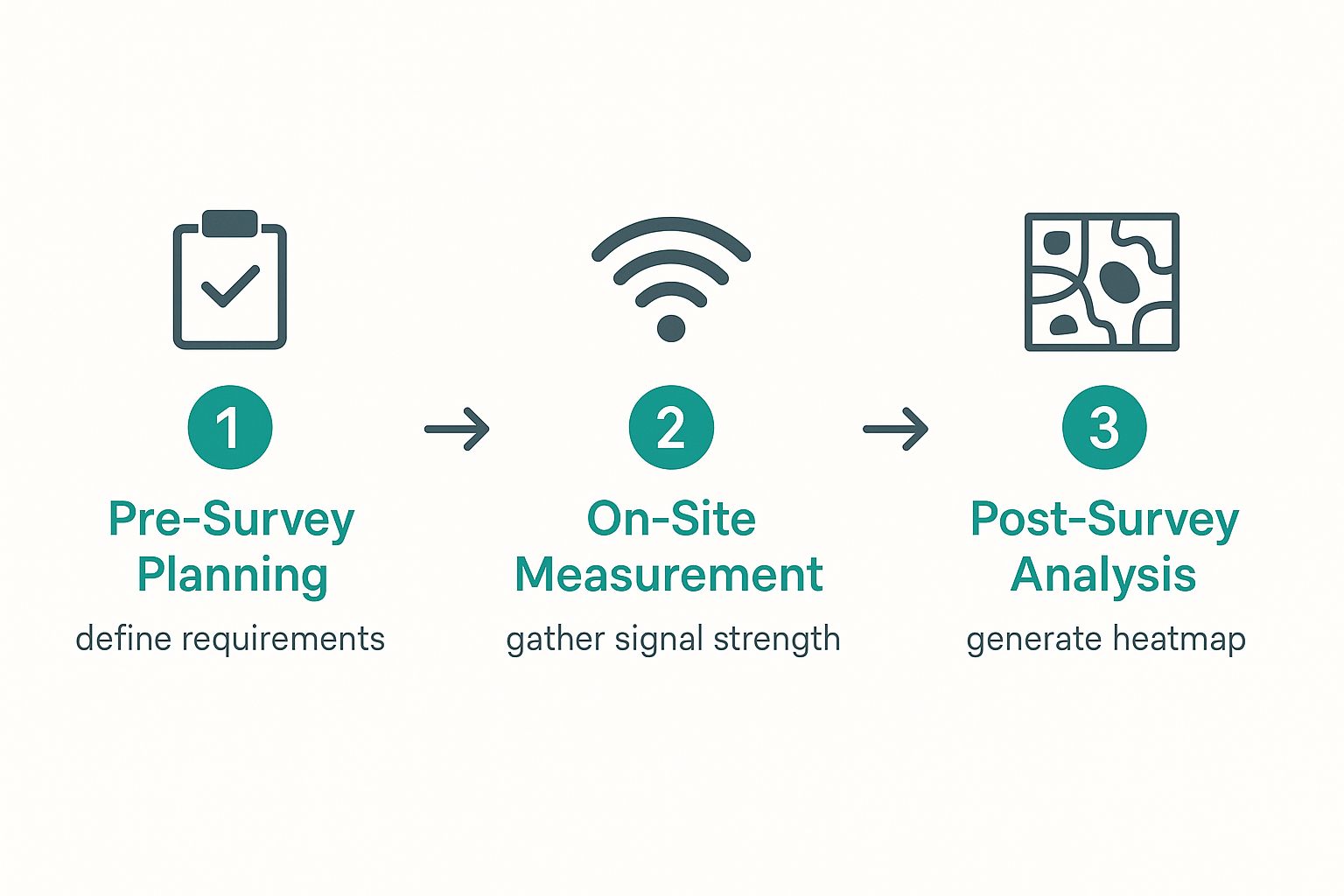

A proper site survey for a wireless network isn't just a single task you check off a list. It’s a methodical, three-part process. I like to think of it as a comprehensive game plan where each stage builds on the one before it, ensuring your network—whether it’s a high-end Cisco system or a sleek Meraki deployment—is designed for success right from the start.

Let's break down how we get it done.

The Predictive Planning Phase

Long before we unbox any hardware or run a single cable, the work begins with a predictive survey. This is essentially the architectural blueprint for your Wi-Fi network. Using specialized software and your building’s floor plans, we can create a digital twin of your space and accurately model how wireless signals will behave.

We feed the model critical details like wall materials—is it just drywall, or are we dealing with concrete or glass? We input floor-to-ceiling heights and even account for large obstacles like shelving or office furniture. This allows us to place virtual access points (APs) and see the predicted coverage. It's an incredibly effective way to get a solid baseline, especially for a new building or a major redesign in a tricky space like a multi-floor office or a sprawling school campus.

This initial modeling helps us answer crucial questions like, "How many APs do we actually need?" and "Where is the absolute best spot for each one?" Getting this right upfront prevents overspending on gear you don't need and makes the physical installation far more efficient.

The flow from planning to the final analysis is a logical journey, with each step feeding into the next to achieve the overall goal.

As you can see, a site survey is a structured process that starts with defining what you need and ends with data-driven proof that you got it.

The On-Site Measurement Phase

As good as predictive models are, they can't see everything. The real world is full of surprises, especially when it comes to radio frequency (RF) behavior. This is where the on-site survey, sometimes called a passive survey, becomes essential. It’s time to get our boots on the ground.

With professional survey tools in hand, we physically walk the entire site, methodically collecting real-world data about the existing RF environment. We’re not just looking at signal strength; we're actively hunting for sources of interference.

Your biggest enemy is often what you can't see. That microwave in the breakroom, countless Bluetooth headsets, old cordless phones, and even the Wi-Fi from the business next door can all wreak havoc on your signal. An on-site survey with a spectrum analyzer is the only real way to sniff out these hidden performance killers.

This phase is where we validate or correct the predictive model. We might discover a wall we thought was drywall is actually reinforced with metal studs, creating a signal dead zone the model never saw coming. Finding these real-world quirks is critical. If you're curious about what else can go wrong, you can learn more about the common culprits and how to deal with interference with your Wi-Fi signal.

The Post-Validation Survey Phase

The last piece of the puzzle happens after your new network is fully installed and configured. The post-validation survey is our quality assurance check. Its job is to confirm that the network performs exactly as we designed it to and meets all the requirements we set out in the beginning.

This is much more than just checking for full signal bars on a phone. We run active tests to measure what really matters: throughput, latency, and how well devices roam from one AP to another. It's also where we make sure your chosen security and access methods work flawlessly in the real world.

For example:

- In a Retail environment, we'll test the Captive Portal from a customer's perspective to ensure the login is quick and painless.

- For a BYOD corporate network, we validate that IPSK or EasyPSK solutions can onboard personal devices securely without creating a support nightmare.

- In an Education setting, we'll simulate a classroom full of students connecting at once to ensure the network can handle the load.

This final check is what turns a well-designed plan into a tangible, high-performing wireless network. It closes the loop and confirms your investment will deliver the reliable experience your users demand.

Choosing the Right Tools for the Job

Trying to conduct a professional site survey for a wireless network without the right gear is a recipe for disaster. It's like trying to navigate a new city without a map—you might get there eventually, but you’ll take a lot of wrong turns and miss the most important landmarks. While basic phone apps can give you a rough idea, they're no substitute for professional-grade hardware and software when designing a business-critical network.

This isn't just about finding a few dead zones. It’s about peering into the invisible world of radio frequency (RF) to understand exactly how your network will behave. Let's get into the gear that separates a hopeful guess from a data-driven network design, especially when working with Cisco or Meraki infrastructure.

The Software Side of Your Toolkit

At the heart of any modern site survey is specialized software. These platforms are far more than simple signal meters; they're sophisticated tools that transform raw RF data into actionable intelligence. When you're picking your software, you need something that can generate detailed heatmaps, simulate network performance before you deploy a single access point, and perform deep RF spectrum analysis.

You'll run this software on a dedicated laptop, starting by loading in your building's floor plans. As you walk the site, the software actively collects data and overlays it onto the plan, giving you a crystal-clear visual of what's happening. You’ll be looking at:

- Signal Strength (RSSI): This is the classic heatmap showing where your signal is strong, weak, or completely absent.

- Signal-to-Noise Ratio (SNR): Honestly, this is even more critical than raw signal strength. It tells you how clear your Wi-Fi signal is compared to all the background RF noise. A strong signal with high noise is still a bad signal.

- Channel Interference: This visualizes which of your access points might be "shouting" over each other or, more likely, competing with dozens of neighboring Wi-Fi networks from other tenants.

This level of detail is non-negotiable, particularly in dense environments like a corporate BYOD office or a bustling Retail space where you’re fighting for clean airwaves.

Essential Hardware for Accurate Readings

Software can't do its job without accurate data, and that's where the right hardware comes in. Let’s be clear: your laptop’s built-in Wi-Fi card is designed for checking email, not for precise scientific measurement.

Pro Tip: For a survey you can stand behind, you need a high-quality, external USB Wi-Fi adapter that is specifically supported by your survey software. These adapters are engineered to capture a much wider and more accurate range of RF data than any consumer-grade chip.

Beyond the adapter, the other piece of hardware I consider essential is a spectrum analyzer. This device allows you to see all the RF activity in your space, not just the Wi-Fi signals. It’s the only reliable way to pinpoint non-Wi-Fi interference from things like microwave ovens, older security cameras, or even certain Bluetooth devices that can absolutely cripple your network's performance.

The need for proper tools is only growing. The enterprise WLAN market recently surged to $2.6 billion in a single quarter, largely driven by new standards like Wi-Fi 6E and Wi-Fi 7. These newer, higher-frequency standards are more easily blocked by walls and other objects, making a meticulous survey with professional tools an absolute necessity for success. You can see more on these market trends on IDC.com.

Tailoring Your Toolkit for Specific Needs

The specific tools you'll need also hinge on the environment and the services you plan to offer. For example, in an Education setting, you have to plan for high-density lecture halls where hundreds of students connect at once. In a Retail environment, your survey needs to guarantee rock-solid connectivity for critical point-of-sale systems while also supporting a robust guest network for shoppers.

Speaking of which, that guest network experience is part of the survey. You must validate that the signal is strong and clean enough to provide a seamless journey through your Captive Portal. After all, a beautifully designed login page is useless if users can't connect to it reliably. For more on that, take a look at our guide on how to set up guest Wi-Fi.

Similarly, if you're deploying more advanced Authentication Solutions like IPSK or EasyPSK for a corporate BYOD policy, your survey has to confirm that the underlying RF foundation is solid enough to support these secure connections without a single hiccup. When you pair the right software with the right hardware, you're not just building a network—you're building one that's ready for anything.

Weaving Authentication and Security into Your Survey

Great signal strength is a fantastic start, but it's only one piece of the puzzle. A truly professional site survey for a wireless network has to look beyond the raw RF physics and consider the people who will actually use it. What’s the point of a strong signal if the login process is clunky, insecure, or flat-out broken?

This is more important than ever. In today's world, security and user experience are non-negotiable. Your survey process must confirm that the physical AP layout can support whatever authentication methods you've chosen. The goal is a smooth, secure connection for everyone, whether it’s a student on campus, a shopper in a store, or an employee at their desk. This is a fundamental planning step for any Cisco or Meraki deployment.

Mapping Out the User Journey

Different places have vastly different needs when it comes to network access. Your survey has to reflect the specific security and authentication models you plan to deploy.

For example, think about a busy Retail space. A guest Captive Portal is usually the first thing a customer sees. You want that first impression to be a good one. Your survey should confirm that you have rock-solid signal strength in high-traffic spots where people are most likely to connect—the entrance, food courts, or checkout lines. If the signal is weak there, users might not even be able to load the splash page, which leads to immediate frustration.

Now, contrast that with a BYOD Corporate environment. The priorities flip completely. Here, it’s all about ironclad security that can handle hundreds or even thousands of personal devices without creating a support nightmare for the IT team. This is where modern Authentication Solutions really prove their worth.

The true measure of a wireless network isn't just about signal bars. It's about how effortlessly that signal translates into a secure and painless connection for the user. Your site survey is where you prove this is achievable before you mount a single AP.

Validating Modern Authentication Solutions

Let's dig into some of the more advanced security models, like IPSK (Identity Pre-Shared Key) or EasyPSK. These have been game-changers for sectors like Education and corporate offices. Why? Because they assign a unique key to every single user or device, giving you WPA2-level security without the headaches of a full-blown 802.1X rollout.

But your site survey has to account for how these systems work in the real world.

- Device Onboarding: How will users get their unique key? Is it through an app, an email, or a self-service portal? Your survey needs to ensure there’s solid Wi-Fi coverage in these specific "onboarding zones."

- Roaming Performance: As someone with an IPSK-authenticated device walks across a campus or through an office building, the handoff between access points must be invisible. The survey helps you validate that your AP placement and channel plan can support this, preventing dropped connections.

- Authentication Traffic: It’s minimal, but authentication does generate traffic. In a packed university common area or a conference room, your survey helps confirm the network can handle hundreds of simultaneous authentication requests during peak login times.

Thinking through these user-focused scenarios during the survey is what elevates a network from being merely functional to being something people actually enjoy using.

The Captive Portal Factor

For any network with a lot of guests, like in retail or hospitality, the Captive Portal is front and center. It's more than just a login screen; it’s a branding opportunity and a way to engage with visitors. Your survey must verify that the user's path to and through that portal is seamless. To learn more about how these systems are built, our guide on what is a captive portal offers a much deeper dive for network managers.

Ultimately, building security into your survey from the start is about designing for reality. By considering how people in Education, Retail, and BYOD corporate settings will actually connect, you ensure your Cisco or Meraki network doesn't just broadcast a signal—it delivers a secure, reliable, and user-friendly experience from the very first click.

Turning Survey Data into an Actionable Report

You’ve walked every inch of the building, your survey laptop has crunched the numbers, and you've collected a mountain of RF data. So, what’s next? This is where the real work begins. The most critical part of a site survey for a wireless network is turning all that complex data into a clear, actionable report that stakeholders can actually understand and use.

A great report doesn't just show problems; it provides concrete, data-backed solutions. Think of it as the bridge between your technical analysis and the final implementation. It’s what gets your plan for that new Cisco or Meraki network the green light.

This step has become absolutely crucial. The global wireless connectivity market is expected to skyrocket from USD 103.87 billion to USD 373 billion by 2034, and that growth is all about the explosion of smart devices and IoT connections. With that much RF noise, a clear report is essential to build a network that actually works. You can dive deeper into the trends in the wireless connectivity market on Precedence Research.

From Raw Data to Clear Visuals

The heart of any good survey report is its visualizations. Let's be honest, nobody wants to sift through spreadsheets of decibel levels. What they need are easy-to-understand heatmaps that tell a story at a glance.

A truly comprehensive report needs to include a few key heatmap types:

- Signal Strength (RSSI): This is the classic heatmap everyone recognizes. It shows exactly where your Wi-Fi signal will be strong, acceptable, or just plain dead. It’s the perfect way to prove you've eliminated coverage holes.

- Signal-to-Noise Ratio (SNR): I’d argue this is even more important than signal strength. This map shows how clear your Wi-Fi signal is compared to background RF noise. A high SNR means a clean, fast, and reliable connection.

- Co-Channel Interference: This visualizes where your own access points are fighting with each other or with a neighbor's network. It's the key to building an intelligent channel plan that avoids self-inflicted performance issues.

Presenting these maps clearly justifies your design choices and helps everyone—from the IT director to the CFO—understand exactly what they're paying for.

Documenting Your Recommendations

Beyond the pretty pictures, your report needs to give specific, actionable recommendations. This is where you connect the visual data to the physical hardware and configuration settings. Your report should be a detailed blueprint for the installers.

Key Insight: A survey report is your primary tool for persuasion. It uses objective data to justify AP placements, channel settings, and hardware choices, turning a technical exercise into a clear business case for a better network.

Your documentation should leave no room for guesswork. I always make sure to include:

- AP Placement Map: A floor plan showing the exact location for every single access point. I often include photos of the intended mounting spots to avoid any confusion on installation day.

- Channel and Power Plan: A detailed list of the recommended channel and power level settings for each AP. This is your strategy to minimize interference and maximize performance.

- Hardware Bill of Materials: A specific list of all required hardware, down to the AP models, mounts, and any necessary switches or cabling.

This level of detail ensures the network gets built precisely as you designed it.

Connecting the Plan to User Experience

Finally, a truly great report always ties back to the user. You need to explain how your technical design will support the specific Authentication Solutions and user needs of that environment. It's about translating the technical into the practical.

For example, in an Education setting, your report should show how the design supports high-density lecture halls and secure device onboarding using IPSK or EasyPSK. For a BYOD Corporate environment, it must demonstrate how the network will securely handle hundreds of personal devices without bogging down. In a Retail space, you'd confirm the AP placement provides excellent coverage near entrances to ensure a smooth Captive Portal login for guests.

The goal is to make complex network management simple, much like the overview provided by a platform like Cisco Meraki.

A dashboard like this translates complexity into clarity, which is exactly what a good site survey report should do. This approach is fundamental, especially when you're dealing with the advanced features that make modern networks tick. For those interested in the nuts and bolts, you can learn more about how unique security keys for Wi-Fi are used to protect these networks.

By creating a report that is both technically sound and easy to digest, you provide immense value and set your wireless project up for success from day one.

Common Wireless Site Survey Questions

When you're diving into a site survey for a wireless network, questions are going to come up. That's a good thing. It means you’re thinking critically about how to build a Wi-Fi network that actually works for the people using it. We've fielded a ton of these over the years, so here are some of the most common ones we hear when clients are planning a new Cisco or Meraki deployment.

How Often Should I Perform a Wireless Site Survey?

A site survey isn't a one-and-done deal. It’s more like a regular health check for your network. You absolutely have to perform a full, in-depth survey before any new wireless network goes live. That's non-negotiable.

But beyond that initial setup, you should really plan for a validation or health-check survey at least once a year. The RF environment is always in flux. New neighboring Wi-Fi networks pop up, office layouts get reconfigured, and all sorts of new interference sources can appear out of nowhere.

You should also trigger a fresh survey anytime your physical space changes significantly. This is especially true for:

- New construction or even just putting up new walls.

- Major shifts in inventory, like rearranging large metal shelving in a warehouse or retail stockroom.

- A big jump in users or devices, which often happens when you roll out a new BYOD Corporate policy or see a spike in enrollment in an Education setting.

The airwaves are a living, breathing thing. A regular check-up ensures your network stays healthy and performs the way you need it to.

Can I Just Use a Mobile App for My Site Survey?

This one comes up a lot. While those Wi-Fi analyzer apps on your phone are great for a quick, informal spot-check, they are no substitute for a professional survey. It’s like using a toy stethoscope versus getting a real EKG—one gives you a rough idea, the other gives you a precise, actionable diagnosis.

Those apps just don't have the precision, the deep analytics, or—most importantly—the spectrum analysis capabilities of professional tools. They can't see non-Wi-Fi interference, and their readings come from basic, consumer-grade antennas, not the specialized adapters used for professional surveys.

For any environment where the Wi-Fi is mission-critical—a school, a Retail store, a corporate office—you have to use dedicated software and hardware. It's the only way to get a true, unfiltered picture of your RF environment. This allows you to design a network that can handle real-world capacity, seamless roaming, and essential security features like Captive Portals or advanced Authentication Solutions like IPSK.

The single biggest—and most expensive—mistake you can make is failing to define what the network needs to do before you start the survey. It's like starting a road trip with no destination in mind. You're just driving.

You must first understand what the Wi-Fi will be used for. A network designed for simple web browsing is a world away from one built for a packed university lecture hall that needs to support video streaming and secure logins for hundreds of students simultaneously. Always start by talking to stakeholders to nail down their real needs for coverage, capacity, and application performance.

Does a Predictive Survey Replace an On-Site Survey?

This is a fantastic question, and the answer is a hard no. A predictive survey is an incredibly useful planning tool, but it’s meant to work with an on-site survey, not replace it.

Think of the predictive model as your first draft. It's an excellent way to figure out an initial AP layout, get a ballpark estimate on hardware costs, and put together a budget. You get a solid, data-driven starting point based on your floor plans and what you know about the wall materials.

But predictive models are only as good as the data you feed them. They can't know about the unexpected RF interference from the business next door that just fired up a new high-power network. They won't detect the hidden metal plating inside a wall that never made it onto the original blueprints.

You only find those real-world curveballs by being physically on-site with a spectrum analyzer. The best practice is a two-phase approach:

- Start with a predictive survey for your initial planning and budgeting.

- Follow up with an on-site survey to validate that model, hunt for real-world interference, and fine-tune the design before you buy and install any gear.

This combination gives you the best of both worlds: the efficiency of planning with a model and the accuracy of real-world data. It's the most reliable way to build a network that can flawlessly support everything from guest Captive Portals to secure authentication with EasyPSK in demanding BYOD environments.

Ready to stop guessing and start building a high-performance wireless network? At Splash Access, we specialize in optimizing the user experience on your Cisco Meraki infrastructure. We can help you deploy powerful, user-friendly authentication solutions, from seamless Captive Portals to secure IPSK for any environment.

Discover how our platform can transform your network at https://www.splashaccess.com.